Research

I work as part of the Mathematical Modelling in Finance and Economics Group in which we model financial systems with uncertain price and uncertain physical flow, leading to non-linear PDEs which must be solved numerically. I have investigated such systems in the world of finance, banking, renewable energy, mining, and Revenue Management systems. If you are interested in a PhD or want to know a bit more then head over to the Mathematical Finance page in MIMS.

Teaching

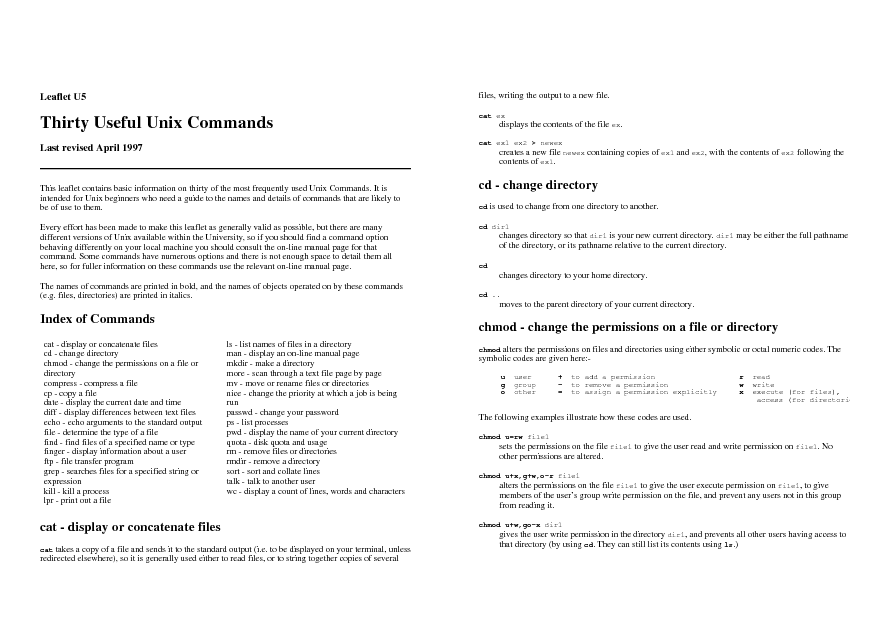

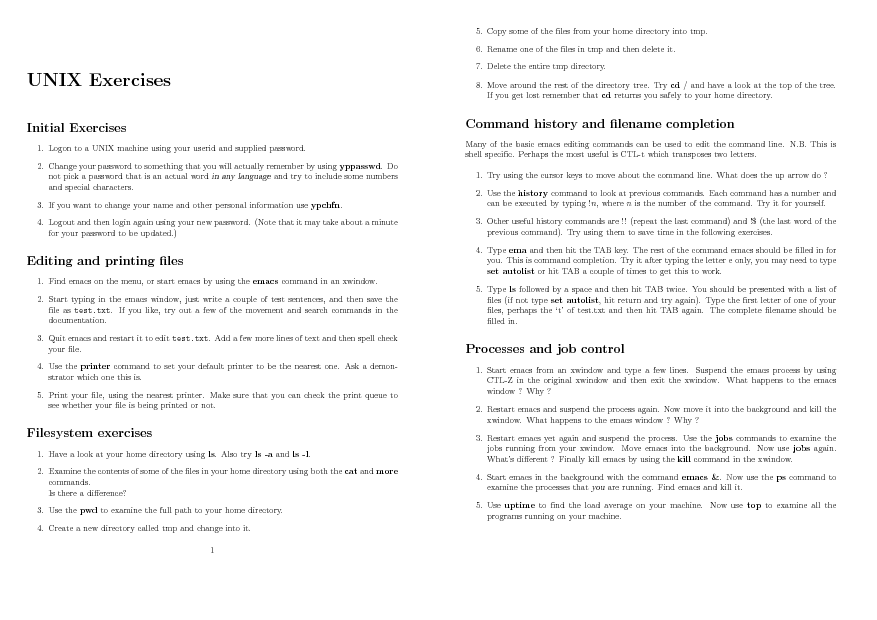

I currently teach MATH60082 Computational Finance to MSc students and will start teaching the third year course MATH39032 Mathematical Modelling in Financial this year. I run introductory courses for the postgrad students on Unix, Latex and using the NAG library, and have in the past given courses on Fortran, C++, matlab and gnuplot. Notes, examples and lectures are all available in the teaching section of my website.

Personal

I've been living, studying and working at University of Manchester for over twenty five years, completing my BSc, MSc, PhD and post doc work in the department! My wife and I have two daughters, aged 11 and 14, so most of my spare time now revolves them! I love playing and watching football but as the years catch up on me I've had to hang up my boots.